Contact us today [email protected]

Only 20-30% of businesses that go to market actually sell successfully—a sobering statistic that most business owners don't discover until they've already engaged a broker and invested months into the sales process. After more than 30 years of selling businesses across the United States marketplace, we've witnessed firsthand why 70-80% of business sales fail to close, and we've compiled this comprehensive resource to help owners understand the real data behind business sale success rates, timelines, valuations, and buyer behavior.

This page contains 171 verified business sale statistics drawn from authoritative industry sources including the International Business Brokers Association (IBBA) Market Pulse Reports, BizBuySell transaction data, Pepperdine University's Private Capital Markets research, U.S. Small Business Administration lending data, and proprietary M&A advisory reports. Each statistic includes full source citations and explanations of what the data means for business owners planning an exit.

What you'll find in this guide:

Unlike generic business-for-sale articles that recycle the same handful of statistics, this resource provides granular, actionable data organized by business size, industry, geography, and deal structure. Whether you're a business owner preparing for exit, a buyer evaluating acquisition opportunities, an M&A advisor benchmarking deal terms, or a researcher seeking credible business transaction data, these statistics offer the most comprehensive view of the U.S. business sale market available in a single resource.

Our methodology: Data has been compiled from Q1 2024 through Q4 2025, with historical comparisons dating back to 2019 where relevant. We've prioritized statistics from recurring industry surveys (IBBA Market Pulse, BizBuySell Insight Reports) to ensure data consistency and reliability. Where multiple sources report conflicting figures, we've noted the variance and cited the most recent or methodologically rigorous source. All statistics are updated quarterly to reflect the latest market conditions.

Why business sale success rates matter: Understanding that only 2-3 out of every 10 businesses successfully sell fundamentally changes how owners should approach exit planning. The data reveals that businesses with realistic valuations, clean financials, advance preparation (ideally 2-3 years), and professional representation have success rates exceeding 60%—more than double the market average. This guide shows you exactly what separates successful exits from failed listings.

📋 Copy this code to embed the chart on your website:

✓ Copied!💡 Tip: Click inside the code box above to select all, or use the "Copy to Clipboard" button. The embed code includes proper attribution linking back to this page.

Stat1 - Only 20–30% of businesses for sale are sold. When a small business is formally put up for sale, only around 20–30% actually complete a transaction and close the deal. This means 70–80% of businesses that go to market never sell. The primary reasons include unrealistic owner price expectations, weak financial records, customer concentration risk, owner dependence, and insufficient preparation. Sources: IBBA Market Pulse Reports, BizBuySell data, business broker surveys

Stat 2 – Only 30-40% of businesses ever transfer ownership through sale. Investment banking analyses suggest only 30–40% of privately owned businesses ever successfully transfer to a new owner through a formal sale. The remainder shut down, are liquidated, or are informally handed to family members. Sources: Exit Planning Institute research, M&A advisor surveys

Stat 3 – More than 50% of businesses that hire a broker never receive an acceptable offer. Roughly half or more of businesses that formally engage a broker never receive an offer the owner is willing to accept. This valuation expectation gap is the most common reason listings are withdrawn. Sources: IBBA Market Pulse, business broker surveys

Stat 4 – Main Street businesses have lower close rates than lower-middle-market deals. Close rates are materially lower for very small "Main Street" businesses (under $2M value) than for lower-middle-market transactions ($2M-$50M), where processes are more professional and buyers more sophisticated. Sources: IBBA Market Pulse, Pepperdine Private Capital Markets Report

Stat 5 – Only 17% of active Main Street deals actually close. In certain Main Street segments, only about 17% of "active deals" that reach accepted offer or due diligence actually close. The majority fail due to financing, due diligence issues, or deal fatigue. Source: IBBA Market Pulse commentary

Stat 6 – 8% of deals take two years or longer to close. Approximately 8% of transactions drag on for two years or more, typically when owners are inflexible on terms, businesses hit operational problems mid-process, or there are buyer changes. Source: IBBA Market Pulse historical data

Stat 7 – 9,546 small businesses were sold in 2024. A total of 9,546 closed small-business transactions were reported through BizBuySell in 2024, representing 5% growth over 2023. Source: BizBuySell 2024 Insight Report

Stat 8 – 2,448 small businesses sold in Q2 2024 alone. Q2 2024 saw 2,448 closed transactions, returning to pre-pandemic volume levels. Source: BizBuySell Q2 2024 Insight Report

Stat 9 – Total enterprise value reached $7.59 billion in 2024. The aggregate value of 9,546 small businesses sold was $7.59 billion, a 15% increase over 2023 despite only 5% volume growth, indicating higher-quality businesses are selling. Source: BizBuySell 2024 Insight Report

Stat 10 – Approximately 500,000 businesses change hands annually in the USA. Combining all sources—marketplaces, private sales, M&A deals, franchise resales, and informal transfers—approximately 500,000 U.S. businesses change ownership each year. Source: BizBuySell research, business transfer estimates

Stat 11 – 1.1 million businesses opened and 983,000 closed in a recent period. SBA data shows approximately 1.1 million small businesses opened while about 983,000 closed, implying most owners exit by shutting down rather than selling. Source: SBA Small Business Profiles

Stat 12 – The U.S. business broker industry is valued at $1.8 billion. The U.S. business brokerage industry generates approximately $1.8 billion in annual revenue, growing due to Baby Boomer exits. Source: Marketdata LLC, U.S. Business Brokers Industry Report 2024

Stat 13 – There are 3,237 business brokerage firms operating in the USA. As of 2025, there are an estimated 3,237 business brokerage firms in the U.S., up 1.5% from 2024. Source: IBISWorld Business Brokers Statistics 2025

Stat 14 – 80% of the business brokerage market remains untapped. Only about 20% of businesses are sold through professional brokers, leaving 80% of the market untapped. Source: U.S. Business Brokers Industry Research Report

Stat 15 – The SBA supported 103,000 financings totaling $56 billion in FY 2024. In FY 2024, the SBA supported around 103,000 loans totaling $56 billion, much of which funds business acquisitions. Source: SBA 2025 Small Business Profiles

Stat 16 – Business broker industry revenue declined at 3.3% CAGR over 5 years. Industry revenue declined at 3.3% CAGR over five years, reaching $1.0 billion in 2025, reflecting economic volatility. Source: IBISWorld Business Brokers Industry Analysis 2025

Stat 17 – The number of business brokers remained flat (0.0% CAGR 2020-2025). The total number of brokerage firms remained essentially unchanged between 2020-2025, suggesting market maturity. Source: IBISWorld Business Brokers Statistics

Stat 18 – BizBuySell facilitates hundreds of thousands of successful sales. BizBuySell reports facilitating "hundreds of thousands of successful business sales" with 3+ million monthly site visits. Source: BizBuySell.com

Stat 19 – 65,000+ businesses are listed annually on BizBuySell. Approximately 65,000+ businesses are listed for sale annually on BizBuySell's platform. Source: BizBuySell marketplace statistics

Stat 20 – Average time to sell a business is 7-9 months. The average time from broker engagement to closing is 7-9 months across Main Street and lower-middle-market deals. Source: IBBA Market Pulse Q4 2024

Stat 21 – Larger deals ($5M-$50M) can take 9-13 months. Businesses valued $5M-$50M historically took up to 13 months to close, though recently this has fallen to 8-9 months. Source: IBBA Market Pulse, 37th & Moss analysis

Stat 22 – Median days on market declined to 168 days in 2024. The median time on market fell to 168 days in 2024, down 3% from the prior year. Source: BizBuySell 2024 Insight Report

Stat 23 – Due diligence typically takes 30-90 days. Due diligence lasts 30-90 days for most deals, though smaller businesses may complete it in 2-4 weeks. Sources: M&A advisor surveys, DealRoom research, Lake Country Advisors

Stat 24 – Short due diligence averages 49 days; long periods average 139 days. "Short" due diligence averages 49 days, "medium" 139 days, with "long" processes exceeding 150 days. Source: Business-sale.com due diligence research

Stat 25 – Post-LOI timeline fell to 3 months in Q4 2024 for $5M-$50M deals. Time from LOI to closing fell to 3 months in Q4 2024, down from a historical average of 4 months. Source: 37th & Moss Q4 2024 Trends

Stat 26 – The typical sale process historically averaged 10 months for $5M-$50M. The complete sale process historically averaged 10 months (4 months post-LOI), now dropped to 8 months total. Source: 37th & Moss analysis

Stat 27 – SaaS M&A due diligence can close in as little as 2 weeks. In hot SaaS markets, due diligence has compressed to as little as 2 weeks, though 5 weeks is more typical. Source: Software Equity Group

📋 Copy this code to embed the chart on your website:

✓ Copied!💡 Tip: Click inside the code box above to select all, or use the "Copy to Clipboard" button. The embed code includes proper attribution linking back to this page.

Stat 28 – Median sale price hit $375,000 in mid-2024. The median sale price reached $375,000 in Q2 2024, up 25% year-over-year—an all-time high. Source: BizBuySell Q2 2024 Insight Report

Stat 29 – Median sale price was $345,000 for full-year 2024. For the full year 2024, the median sale price was $345,000, up 3% over 2023. Source: BizBuySell 2024 Full Year Insight Report

Stat 30 – Median sale price dropped to $325,000 in Q3 2024. Q3 2024 saw the median fall to $325,000, down 13% from the Q2 peak, though financials remained strong. Source: BizBuySell Q3 2024 Insight Report

Stat 31 – Sellers achieve approximately 95% of asking price at closing. Sellers average about 95% or more of their asking price or valuation benchmark at closing. Source: IBBA Market Pulse

Stat 32 – EBITDA multiples range from 3.6x to 8.8x by size and sector. Pepperdine research finds median EBITDA multiples range from 3.6x (smaller, riskier) to 8.8x (larger, higher-growth). Source: Pepperdine Private Capital Markets Report

Stat 33 – Lower-middle-market businesses ($5M-$50M) average 6.0x EBITDA. Businesses valued $5M-$50M averaged 6.0x EBITDA in late 2024, matching strong 2021 valuations. Source: IBBA Q4 2024 Market Pulse

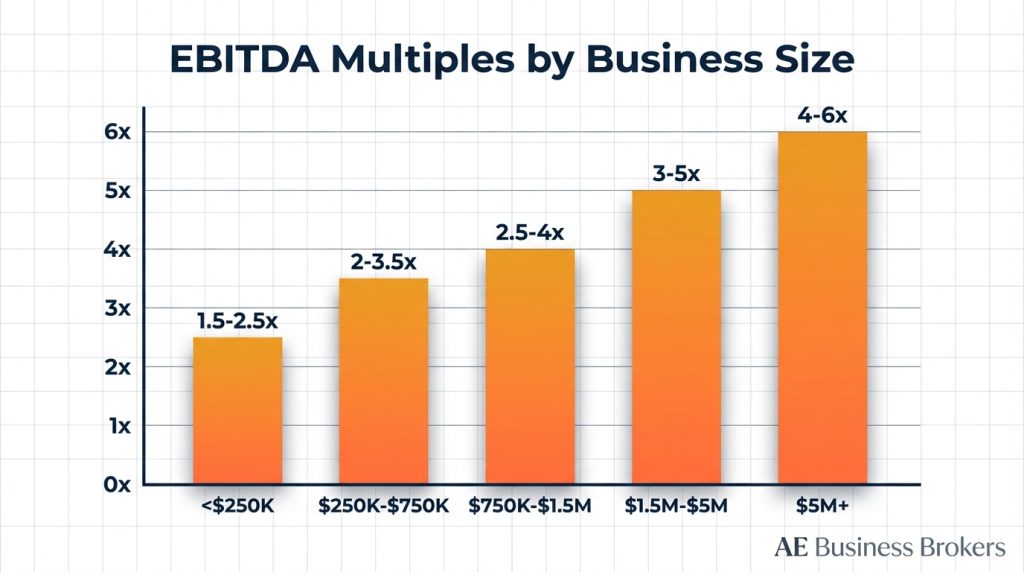

Stat 34 – Businesses under $250K EBITDA sell for 1.5-2.5x EBITDA. Very small businesses (<$250K EBITDA) typically sell for 1.5-2.5x EBITDA. Source: Raincatcher business valuation research

Stat 35 – Businesses with $250K-$750K EBITDA sell for 2.0-3.5x. Small businesses generating $250K-$750K EBITDA command 2.0-3.5x multiples. Source: Raincatcher research

Stat 36 – Businesses with $750K-$1.5M EBITDA sell for 3.0-5.5x. Companies with $750K-$1.5M EBITDA sell for 3.0-5.5x multiples. Source: Raincatcher research

Stat 37 – Businesses with $1.5M-$5M EBITDA sell for 4.0-9.0x. Companies with $1.5M-$5M EBITDA command 4.0-9.0x multiples. Source: Raincatcher research

Stat 38 – Main Street deals (<$3M revenue) typically sell for 2.5-3.5x SDE. 90% of American businesses generate under $3M revenue and typically sell for 2.5-3.5x seller's discretionary earnings (SDE). Source: Raincatcher valuation research

Stat 39 – Lower-middle-market companies trade at 4-15x EBITDA. Companies with $2M-$100M revenue typically trade at 4-15x adjusted EBITDA depending on numerous factors. Source: Raincatcher research

Stat 40 – Small businesses typically sell for 2x-4x SDE. Small businesses (estimated value under approximately $10M) almost exclusively use SDE as the valuation metric and sell for 2x-4x SDE. Source: FE International valuation research 2025

Stat 41 – Cash flow multiples averaged 2.57 in 2024. The average cash flow multiple rose from 2.49 in 2023 to 2.57 in 2024, reflecting stronger valuations. Source: BizBuySell 2024 Insight Report

Stat 42 – Median cash flow was $158,950 in 2024. Median cash flow for sold businesses increased 3% to $158,950 in 2024. Source: BizBuySell 2024 Insight Report

Stat 43 – Median revenue was $703,000 in 2024. Median revenue for sold businesses increased 3% to $703,000 in 2024. Source: BizBuySell 2024 Insight Report

📋 Copy this code to embed the chart on your website:

✓ Copied!💡 Tip: Click inside the code box above to select all, or use the "Copy to Clipboard" button. The embed code includes proper attribution linking back to this page.

Stat 44 – Manufacturing businesses saw 35% increase in sales and 31% price jump. Manufacturing had a 35% increase in businesses sold and a 31% median price rise, outpacing other sectors. Source: BizBuySell 2024 data

Stat 45 – Manufacturing median sale price is $700,000. Manufacturing businesses have a median sale price of $700,000 with cash flow multiples up 9.5%. Source: BizBuySell 2024 Insight Report

Stat 46 – Online/technology businesses surged 74% in transaction volume. Online and technology businesses saw a 74% surge in transactions, with median sale price of $650,000 (down 24% from 2023). Source: BizBuySell 2024 Insight Report

Stat 47 – Building and construction grew 10% with $760,000 median price. Building and construction grew 10% in acquisitions with median sale price of $760,000 and stable valuations. Source: BizBuySell 2024 Report

Stat 48 – Service sector represents 40% of transactions. Service businesses account for 40% of all transactions with median sale price of $325,000. Source: BizBuySell 2024 data

Stat 49 – Service sector median price is $340,000 with 5% growth. Service sector median sale price rose 5% to $340,000 in 2025, with cash flow multiples up 2% to 2.52. Source: BizBuySell Insight Report 2025

Stat 50 – Financial services saw 38% gain in transactions. Financial services reported 38% gain in transactions with median sale price up 40% and cash flow up 15%. Source: BizBuySell 2025 data

Stat 51 – Technology services saw 12% gain with 15% price increase. Technology services saw 12% transaction growth, 15% median price increase, and 6% cash flow growth. Source: BizBuySell 2025

Stat 52 – Architectural/engineering firms up 17% in transactions. Architecture and engineering firms saw 17% transaction growth, 38% price increase, and 44% cash flow increase. Source: BizBuySell 2025

Stat 53 – Retail transactions remained flat with $255,000 median price. Retail saw flat transaction volume with median sale price of $255,000 and steady demand. Source: BizBuySell 2024

Stat 54 – Restaurant sales flat with $225,000 median, 4% revenue decline. Restaurant sales volume remained flat with median price $225,000, 4% revenue drop offset by higher margins. Source: BizBuySell 2024

Stat 55 – Restaurant median revenue reached $780,823 in Q2 2025. Restaurant median revenue was $780,823 in Q2 2025, up 6.9% year-over-year, showing sustained demand. Source: BizBuySell Q2 2025 Restaurant Analysis

Stat 56 – Restaurant cash flow declined 8% despite revenue growth. Restaurant median cash flow declined 8% due to tighter margins from rising food and labor costs. Source: BizBuySell Q2 2025

Stat 57 – Restaurant transactions down 16% year-over-year in Q2 2025. General business brokers reported 16% drop in restaurant sales year-over-year in Q2 2025. Source: BizBuySell Q2 2025

Stat 58 – E-commerce businesses typically sell for 1.85x SDE. According to Flippa historical data, e-commerce businesses sell for average of 1.85x SDE, with quality businesses reaching 2.0-4.0x. Source: Flippa transaction data

Stat 59 – E-commerce EBITDA multiples range 3.0x-10x. Larger e-commerce companies achieve EBITDA multiples of 3.0x to 10x based on growth and profitability. Source: Peak Business Valuation data

Stat 60 – E-commerce revenue multiples typically 0.3x-0.5x. Revenue multiples for high-growth e-commerce businesses range 0.3x-0.5x for market-capture strategies. Source: E-commerce valuation research

Stat 61 – California has approximately 5,500 businesses for sale. California currently has approximately 5,500 businesses listed for sale, the highest in the nation. Source: BizBuySell California market data

Stat 62 – California median asking price is $360,000. California's median asking price for businesses is $360,000. Source: BizBuySell California data

Stat 63 – California median revenue is $630,000. California businesses for sale report median revenue of $630,000. Source: BizBuySell California data

Stat 64 – California median earnings are $150,000. California median seller discretionary earnings are $150,000. Source: BizBuySell California data

Stat 65 – California earnings multiple is 2.5x. California businesses list at an average earnings multiple of 2.5x. Source: BizBuySell California data

Stat 66 – California revenue multiple is 0.6x. California businesses list at an average revenue multiple of 0.6x. Source: BizBuySell California data

Stat 67 – California profit margin averages 23%. California businesses for sale show an average profit margin of 23%. Source: BizBuySell California data

Stat 68 – Texas has approximately 3,300 businesses for sale. Texas currently has approximately 3,300 businesses listed for sale. Source: BizBuySell Texas market data

Stat 69 – Texas median asking price is $350,000. Texas median asking price is $350,000. Source: BizBuySell Texas data

Stat 70 – Texas median revenue is $650,000. Texas businesses report median revenue of $650,000. Source: BizBuySell Texas data

Stat 71 – Texas median earnings are $150,000. Texas median seller discretionary earnings are $150,000. Source: BizBuySell Texas data

Stat 72 – Texas earnings multiple is 2.3x. Texas businesses sell at an average earnings multiple of 2.3x. Source: BizBuySell Texas data

Stat 73 – Texas revenue multiple is 0.5x. Texas businesses sell at an average revenue multiple of 0.5x. Source: BizBuySell Texas data

Stat 74 – Florida has approximately 5,700 businesses for sale. Florida currently has approximately 5,700 businesses listed for sale. Source: BizBuySell Florida market data

Stat 75 – Florida median asking price is $350,000. Florida's median asking price is $350,000. Source: BizBuySell Florida data

Stat 76 – Florida median revenue is $610,000. Florida businesses report median revenue of $610,000. Source: BizBuySell Florida data

Stat 77 – 1,223 businesses sold in Florida in 2021. Florida saw 1,223 businesses sold in 2021, up 21% from 2020 (1,011 sales). Source: Green & Co Florida business sales analysis

Stat 78 – Florida average sold price was $630,374 in 2021. Florida's average sold price in 2021 was $630,374, up 57% from 2020 ($402,636). Source: Green & Co analysis

Stat 79 – Florida average SDE was $196,614 in 2021. Florida businesses had average SDE of $196,614 in 2021, up 31% from 2020. Source: Green & Co analysis

Stat 80 – New York City metro had 116 businesses sold in Q2 2024. NYC metro saw 116 businesses sold in Q2 2024 with median sale price of $467,500. Source: BizBuySell NYC Q2 2024 analysis

Stat 81 – NYC metro has 3,607 active listings. NYC metro had 3,607 active business listings in Q2 2024. Source: BizBuySell NYC data

Stat 82 – NYC median asking price is $390,000. NYC active listings have median asking price of $390,000. Source: BizBuySell NYC Q2 2024

Stat 83 – NYC median revenue is $700,000. NYC active listings report median revenue of $700,000. Source: BizBuySell NYC data

Stat 84 – NYC cash flow multiple averaged 2.75 in Q2 2024. NYC closed deals averaged 2.75x cash flow in Q2 2024, up from 2.35x in Q1. Source: BizBuySell NYC analysis

Stat 85 – California received 6,109 SBA 7(a) loan approvals totaling $3.63B. California leads in SBA lending with 6,109 approvals worth $3.63 billion, representing 13.2% of national SBA lending. Source: Bankrate SBA data 2023

Stat 86 – Texas received 5,530 SBA loans totaling $3.7B. Texas had 5,530 SBA loan approvals totaling $3.7 billion. Source: LendingTree SBA data FY2024

Stat 87 – Florida received 6,560 SBA loans totaling $3.6B. Florida received 6,560 SBA loan approvals totaling $3.6 billion. Source: LendingTree SBA data FY2024

Stat 88 – California average SBA loan per company was $584,094. California companies received average SBA loans of $584,094. Source: LendingTree FY2024 data

Stat 89 – Texas average SBA loan per company was $667,136. Texas companies received average SBA loans of $667,136. Source: LendingTree FY2024

Stat 90 – Florida average SBA loan per company was $541,630. Florida companies received average SBA loans of $541,630. Source: LendingTree FY2024

📋 Copy this code to embed the chart on your website:

✓ Copied!💡 Tip: Click inside the code box above to select all, or use the "Copy to Clipboard" button. The embed code includes proper attribution linking back to this page.

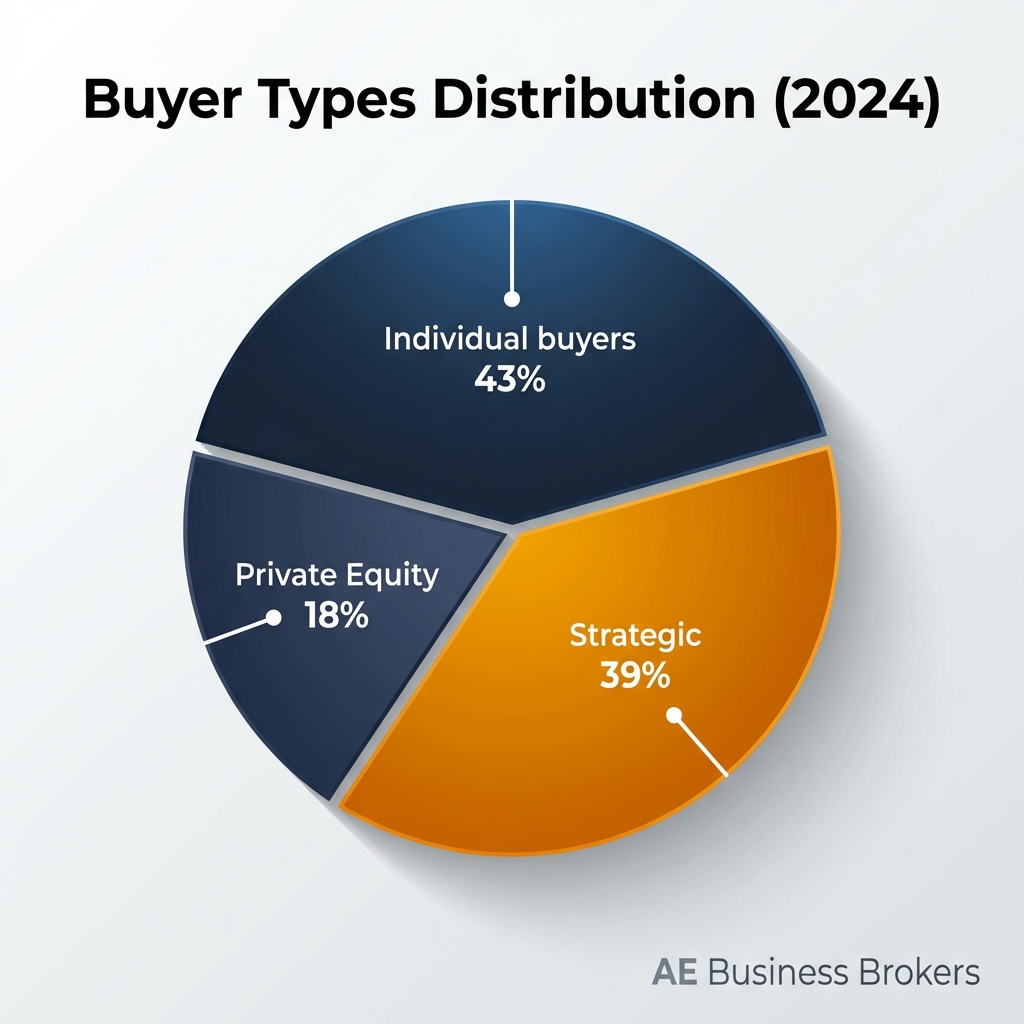

Stat 91 – Strategic buyers account for 55-57% of closed deals. Strategic buyers (existing companies in same/adjacent industry) represent 55-57% of closed transactions. Source: Pepperdine Private Capital Markets Report

Stat 92 – Individual buyers represented 36% of $2M-$50M deals in 2023. Individual buyers accounted for 36% of deals valued $2M-$50M in 2023. Source: 37th & Moss analysis

Stat 93 – Strategic buyers represented 39% of deals in 2023. Strategic acquirers generated 39% of deal activity in 2023. Source: 37th & Moss analysis

Stat 94 – Private equity buyers represented 23% of deals in 2023. PE buyers represented 23% of $2M-$50M transactions in 2023. Source: 37th & Moss analysis

Stat 95 – Individual buyers represented 31-40% of deals from 2018-2022. Individual buyers consistently represented 31-40% of transactions over five years. Source: 37th & Moss historical analysis

Stat 96 – 70% of deals below $2M were completed by individual buyers in 2024. Individual buyers (first-time and serial) made up 70% of sub-$2M deals in 2024. Source: 37th & Moss Q4 2024 analysis

Stat 97 – 43% of $2M-$50M deals were individual buyers in 2024. Individual buyers accounted for 43% of $2M-$50M acquisitions in 2024, outpacing strategic and PE. Source: 37th & Moss Q4 2024

Stat 98 – 51% of advisors see no premium for strategic buyers. About 51% of respondents saw no pricing premium for strategic buyers over financial buyers. Source: Pepperdine analysis

Stat 99 – 33% observe 1-20% strategic buyer premiums. Roughly 33% observed premiums of 1-20% for strategic buyers in some deals. Source: Pepperdine analysis

Stat 100 – Buyers in 30s-40s increasingly using SBA loans to escape corporate life. Advisors report significant shift toward younger first-time buyers in 30s-40s using SBA loans, willing to pay premium multiples. Source: BizBuySell 2025 Insight Report advisor commentary

📋 Copy this code to embed the chart on your website:

✓ Copied!💡 Tip: Click inside the code box above to select all, or use the "Copy to Clipboard" button. The embed code includes proper attribution linking back to this page.

Stat 101 – 40% of U.S. small business owners are Baby Boomers. About 40% of small-business owners are Baby Boomers, creating the "silver tsunami" exit wave. Source: Project Equity research, Exit Planning Institute

Stat 102 – 2.3 million businesses owned by aging Boomers. Approximately 2.3 million small businesses are owned by aging Baby Boomers, employing about 24.7 million people. Source: Project Equity national study

Stat 103 – Business owners 55+ increased from 32% to 42% since 2000. The percentage of business owners aged 55+ rose from 32% to 42% since 2000. Source: University of Connecticut School of Business

Stat 104 – Boomers own 51% of privately held businesses worth $10 trillion. Baby Boomers control 51% of privately held U.S. businesses, representing 3 million firms valued at $10 trillion. Source: Business succession planning reports

Stat 105 – 58% of Boomer entrepreneurs plan to sell within 5 years. 58% of Baby Boomer entrepreneurs expect to sell within five years, yet only 14% have an exit plan as a priority. Source: Exit planning surveys 2025

Stat 106 – Seller median age is 50-59 (35% of sellers). 35% of sellers are aged 50-59, making it the most common age bracket. Source: BizBuySell Demographics Survey 2016

Stat 107 – 19% of sellers are aged 60-69. 19% of business sellers are in the 60-69 age range. Source: BizBuySell Demographics Survey

Stat 108 – 25% of sellers are aged 40-49. 25% of sellers are in the 40-49 age bracket. Source: BizBuySell Demographics Survey

Stat 109 – Male sellers represent 78% of the market. 78% of business sellers are male, while 22% are female. Source: BizBuySell Demographics Survey

Stat 110 – 57% of sellers earn over $100,000 annual household income. Over half (57%) of business sellers have annual household incomes exceeding $100,000. Source: BizBuySell Demographics Survey

Stat 111 – Retirement is the #1 reason across all price ranges. Retirement is consistently the top motivation for selling in both Main Street and lower-middle-market deals. Source: IBBA Market Pulse Q4 2024

Stat 112 – 60% of sellers in $500K-$1M range cite retirement. In deals valued $500K-$1M, roughly 60% of sellers cite retirement as primary reason. Source: IBBA Market Pulse 2025

Stat 113 – No owners in $5M-$50M range spent more than 2 years planning exit. In the $5M-$50M range, advisors observed no owners spent more than two years planning their exit. Source: IBBA Q4 2024 Market Pulse

Stat 114 – 70-75% of owners regret selling within 12 months. About 70-75% experience significant regret within a year due to emotional and lifestyle factors. Source: Exit Planning Institute

Stat 115 – Only 2-5% are satisfied with net proceeds. Only 2-5% report being happy with after-tax proceeds after fees and deal structures. Source: Exit Planning Institute

Stat 116 – 60% of regretful owners had no post-exit plan. Around 60% who regretted their sale had no formal personal plan for life after exit. Source: Exit planning research

Stat 117 – Main Street brokers charge 8-10% commission. Business brokers typically charge 8-10% for businesses under $1M, with 10% being most common. Source: Midstreet, BizBuySell

Stat 118 – Commission range is 10-15% for $100K-$1M businesses. Typical commission is 10-15% for businesses in this range. Source: BizBuySell broker fees guide

Stat 119 – Double Lehman formula common for $1M-$5M. Most brokers use: 10-12% on first $1M, 8% on second, 6% on third, 4% on fourth, 2% after. Source: Morgan & Westfield

Stat 120 – A $5M business pays approximately $300K in broker fees. Using Double Lehman: $100K+$80K+$60K+$40K+$20K = $300K. Source: Morgan & Westfield

Stat 121 – M&A advisors charge 4-12% on small deals under $10M. M&A advisory fees average 4-12% on deals under $10M. Source: BizAdvisoryBoard

Stat 122 – Mid-market M&A fees are 2-5%. M&A fees drop to 2-5% for mid-market deals. Source: BizAdvisoryBoard

Stat 123 – Large M&A fees are 1-2%. Large transaction fees fall to 1-2%. Source: BizAdvisoryBoard

Stat 124 – Typical minimum M&A fee is $250K+. Most M&A firms have minimum fees of $250K or more. Source: BizAdvisoryBoard

Stat 125 – Buy-side M&A fees are typically 0.5-2% of transaction value. Buyers pay 0.5-2% depending on deal size and complexity. Source: DealRoom

Stat 126 – 82% of Main Street sellers willing to offer seller financing. About 82% of Main Street sellers open to competitive seller financing rates. Source: IBBA Market Pulse

Stat 127 – 70% of lower-middle-market sellers willing to offer seller financing. 70% of $2M-$50M sellers willing to provide seller financing. Source: IBBA Market Pulse

Stat 128 – Exit planning advisor population grew 70% in 2 years. Exit planner population reached 7,267, up 70% in two years. Source: Exit Planners Survey 2025

Stat 129 – 75% of owners want to exit within 10 years. 75% of business owners would like to exit within the next 10 years. Source: Exit Planning Institute 2023

Stat 130 – 32% of owners have no formal exit strategy. Despite exit desires, 32% have no formal exit strategy. Source: Exit Planning Institute 2023

Stat 131 – Buyer median age is 50-59 (36% of buyers). 36% of buyers are aged 50-59. Source: BizBuySell Demographics Survey

Stat 132 – 29% of buyers are aged 40-49. 29% fall in the 40-49 bracket. Source: BizBuySell Demographics Survey

Stat 133 – Male buyers represent 77% of the market. 77% of buyers are male, 23% female. Source: BizBuySell Demographics Survey

Stat 134 – 47% of buyers earn over $100K annually. Just over 47% of buyers have household incomes exceeding $100K. Source: BizBuySell Demographics Survey

Stat 135 – 25.5% of buyers earn under $50K. 25.5% earn less than $50K annually. Source: BizBuySell Demographics Survey

Stat 136 – "Be my own boss" motivates 68% of buyers. 68% of buyers cite independence as primary motivation. Source: BizBuySell Demographics Survey

Stat 137 – "Better income" motivates 51% of buyers. 51% seek higher income potential. Source: BizBuySell Demographics Survey

Stat 138 – Buyers are younger than sellers (23% under age 40). 23% of buyers are 39 or under vs 14% of sellers. Source: BizBuySell Demographics Survey

Stat 139 – 42% of buyers say performance is most important. 42% prioritize business performance when evaluating opportunities. Source: BizBuySell 2024

Stat 140 – 60% of buyers reported Fed rate cuts had no effect on timeline. Despite three Fed rate cuts in 2024, 60% said it didn't affect their purchase timeline. Source: BizBuySell 2024

SECTION 13: DEAL STRUCTURES & FINANCING

Stat 141 – Earn-outs dropped from 10% to 2% of deal value. Earn-outs in $5M-$50M deals fell from approximately 10% peak to approximately 2% of consideration. Source: IBBA Q4 2024

Stat 142 – SBA 7(a) loans go up to $5 million. SBA 7(a) offers loans up to $5M for acquisitions, partner buyouts, and expansion. Source: SBA.gov

Stat 143 – Average SBA 7(a) loan was $443,097 in FY2024. The average 7(a) loan size was $443,097. Source: LendingTree SBA study

Stat 144 – Average SBA 504 loan was $1.1 million. The average 504 loan was significantly larger at $1.1M. Source: LendingTree

Stat 145 – Working capital adjustments typically 2-3% of transaction value. Post-closing working capital adjustments commonly run 2-3% of deal value. Source: M&A transaction analysis

Stat 146 – Holdbacks and escrows often exceed 2-3% level. Holdback and escrow amounts frequently exceed the 2-3% threshold. Source: M&A value creation analysis

Stat 147 – Adjustment escrows don't follow the "1% rule". The common "1% rule" for adjustment escrows doesn't consistently apply across deals. Source: Goodwin Law M&A research

Stat 148 – 66.7% senior debt financing for $1M-$10M add-ons in 2024. Small add-on deals averaged 66.7% senior debt in Q1-Q3 2024. Source: GF Data

Stat 149 – Only 19.6% equity contribution for small add-ons. Equity contribution was just 19.6% for $1M-$10M add-ons. Source: GF Data

Stat 150 – 98% of Rocky Mountain BA transactions are asset sales. The vast majority (98%) of small-to-medium transactions are structured as asset sales. Source: Rocky Mountain Business Advisors

Stat 151 – Approximately 30% of all transactions are stock sales. DealStats reports roughly 30% of transactions use stock sale structure. Source: DealStats database

Stat 152 – Stock sales more common as business size increases. Smaller deals favor asset sales; larger deals increasingly use stock structures. Source: Transaction structure research

Stat 153 – Global franchise resale market expected to reach $17.83B by 2035. The market is projected to grow from $11.39B (2025) to $17.83B (2035) at 4.7% CAGR. Source: Business Research Insights

Stat 154 – Franchise resale inquiries rose 27%. Inquiries increased 27% globally with 24% of franchise transitions via resales. Source: Franchise Resale Market research

Stat 155 – 811,000 franchise establishments in the U.S. in 2024. The U.S. had an estimated 811,000 franchise locations. Source: Statista

Stat 156 – Franchise resale listings rose 18% in 2023 due to Boomer retirements. SBA data shows 18% increase driven by retiring Baby Boomers. Source: Franchise Resale Market research

Stat 157 – 22% of new franchise buyers prefer resales over new units. IFA noted 22% prefer acquiring established outlets. Source: IFA research

Stat 158 – 24% of total franchise transactions in 2023 were resales. Nearly one-quarter of all franchise deals were resales. Source: U.K. Department for Business and Trade

Stat 159 – We Sell Restaurants grew 15.5% while general market fell 16%. The specialist broker outperformed the general market by 31.5 percentage points in restaurant resales. Source: We Sell Restaurants Q2 2025

Stat 160 – Franchise resales up 62.7% at We Sell Restaurants. Franchise resales nearly doubled year-over-year. Source: We Sell Restaurants 2025

Stat 161 – Business owners spend $35.5B annually during ownership transitions. Buyers and sellers combined spend over $35B on suppliers/vendors during transitions. Source: BizBuySell ownership transition survey

Stat 162 – 83% of buyers increased spending during transition. 83% of buyers either increased spending, added products, or switched vendors. Source: BizBuySell survey

Stat 163 – 33% of sellers increased spending during transition. 33% of sellers invested in their business pre-sale to support higher valuations. Source: BizBuySell survey

Stat 164 – 53% of new owners added or switched providers. 53% added new providers or switched entirely post-acquisition. Source: BizBuySell survey

Stat 165 – 59% of advisors reported more signed NDAs in 2024 vs 2023. Buyer engagement increased at the NDA stage. Source: IBBA Q4 2024

Stat 166 – 48% of advisors saw more LOIs submitted in 2024. Letter of intent activity rose year-over-year. Source: IBBA Q4 2024

Stat 167 – 43% of advisors described lending as "more restrictive" in 2024. Despite growth in deal volume, lending tightened. Source: IBBA Q4 2024

Stat 168 – 34% of owners say performance improved since last year. More than one-third report better business performance. Source: BizBuySell 2024

Stat 169 – 58% credit customer increases for improvement. 58% attribute performance gains to increased customers. Source: BizBuySell 2024

Stat 170 – PE has approached 20% of owners about selling. One-fifth report private equity inquiries. Source: BizBuySell 2025

Stat 171 – 46% report multiple PE inquiries per year. Nearly half receive repeated PE approaches annually. Source: BizBuySell 2025

Unlock a free premium market valuation provided by the nation’s leading brokerage. With our 30-year track record, $2 billion in transactions, and a global team of 25+ experts, we find your ideal buyer in under 4 months, often above market value

The owners of this innovative flat roofing company in Southern California had recently relocated to Florida to be closer to family. Our team generated 106 interested buyers. At the outset, they had sought a full sale of the business, but after our team identified a buyer seeking a partnership, we collectively shifted focus to find the right solution for all parties. Navigating licensing hurdles and location constraints, our team assisted the owners with deal structure: sell 50% of the business to the new owner and gradually phase out of the business. This allowed the new partner time to obtain proper licensure and preserved significant cash flow for the owners while they oversaw a slow transition over several years. All sales look different, and the deal innovation for this company ensured a positive outcome for all.

Luxury optical retailer with two stores, dominant in one metro area. The business is profitable, has a loyal, repeat customer base, and has a unique brand and sales process. Exit challenges were: a) the financials were not"buyer ready" and b) most buyers were local and did not have a bigger vision and price in mind. Our team provided strategic advice to the accounting firm and the owner to overhaul the accounting system, resulting in buyer-ready financials. Our team attracted an international strategic buyer who paid an amount that was much higher than that oflocal buyers and met client expectations.

I was impressed that this was a female-led business, and after speaking with several other brokers, I found the team more authentic and caring than those I had spoken to. I would not have been able to sell my business with them.

With over 6,800 restaurants worldwide. Dairy Queen is one of the top franchises in the world and has 95% consumer brand recognition. After running two DQ franchises in Kansas for 17 years, the owners were ready for their next stage of life. Our team worked with 95 buyers interested in purchasing the two franchises, allowing the new owner to be semi-absentee given the tenure and experience of current management in place at both stores. Our team oversaw multiple offers, resulting in a sale value over the asking price. With attention to detail in working with the Dairy Queen Corporate Franchise Transition group, we exceeded our expectations by finding the right buyer at the right time.